7/8 Torchbearer Weekly Policy Update

Thank you for letting us be your trusted source for local, state, and federal policy updates. Let’s dig in…

- Indiana Leads on 988 Crisis Call Response

- Where The Economy Stands Halfway Through ‘24

- State Awards $51M to Support Housing Infrastructure

- Analysis Finds that Indiana’s Housing Affordability Gap is Growing

- The Labor Market Reflects Continued Resilience Amid Slowdown

- Share the Torchbearer Newsletter with Your Network!

- Important Dates

Let’s dive in.

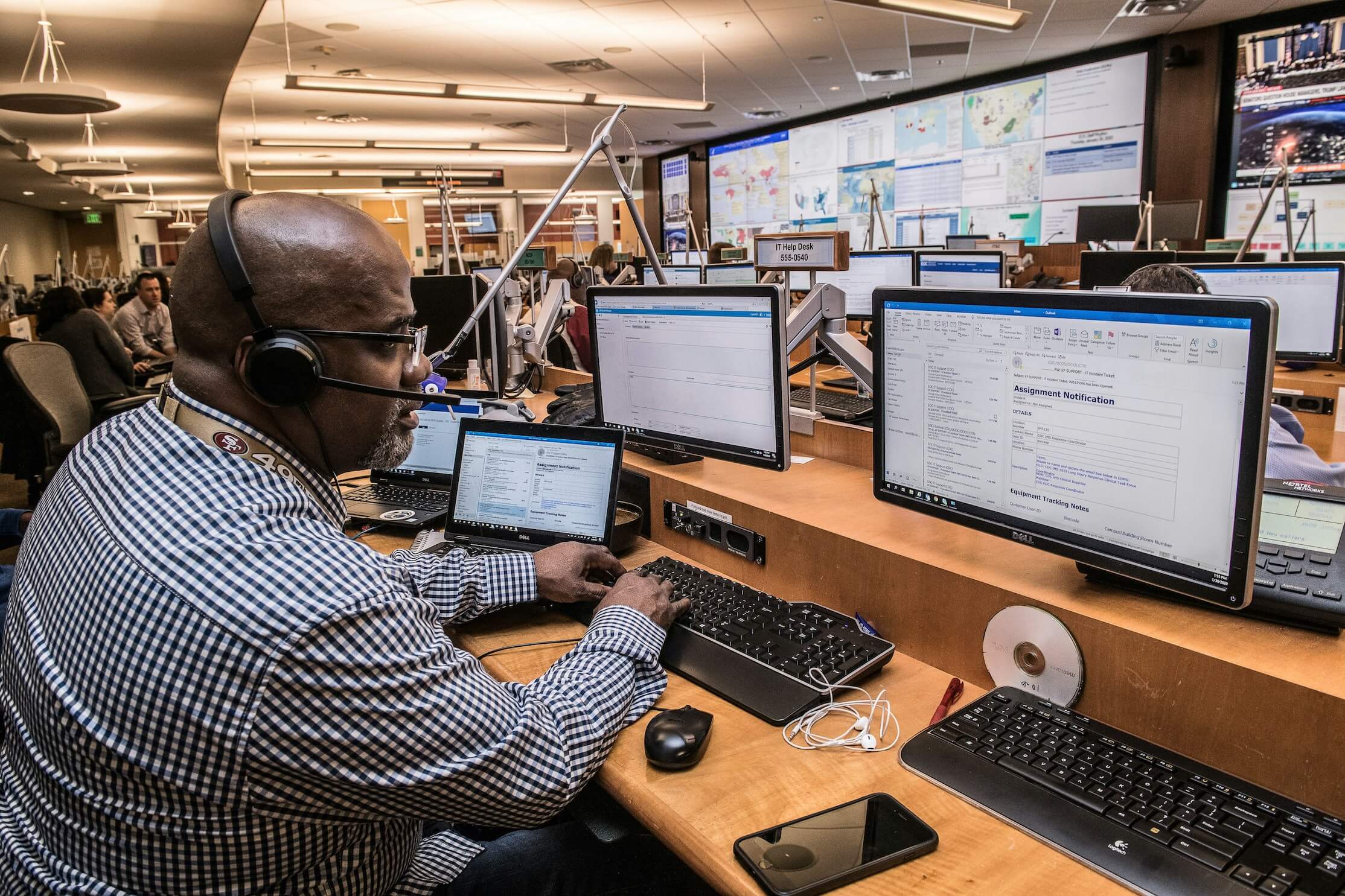

Indiana Leads on 988 Crisis Call Response

Indiana continues to lead the nation in its crisis response, with one of the highest rates of in-state answered calls to the revamped national suicide prevention hotline.

Why it matters: The 988 hotline, established nationwide in 2022, replaced the Be Well Crisis Helpline (211) created by Mental Health America of Indiana in 2020.

- Starting last week, 211 callers seeking mental health support will be directed to 988.

The big picture: Congress gave states $1 billion to build out the 988 hotline, amid nationwide concern over worsening mental health, with the expectation that states would establish their own long-term funding to operate call centers and crisis services.

- Those efforts have been uneven, contributing to significantly lower response times in certain states. As with much of the health care system, the level of crisis services available to people depends greatly on where they live.

- Though all states use surcharges on cellphone bills to fund 911 services, just 10 states so far have done the same for 988, according to a new report from mental health advocacy group Inseparable shared first with Axios.

Zoom in: Indiana has not put in place a cellphone surcharge to fund 988 yet, instead relying on a combination of federal and state funds so far.

By the numbers: 94% of 988 calls placed in Indiana were answered in state, the fourth-highest rate in the nation and better than the national average of 88%.

- Indiana now has four call centers and one text center to respond to 988 calls, according to reporting from the Indiana Capital Chronicle.

Where The Economy Stands Halfway Through ‘24

The soft landing seems to have stuck, inflation has been frustratingly persistent, rate cuts will be slower to arrive than many thought, and small cracks are showing up in the growth outlook.

The big picture: That is where the U.S. economy stands as we pass the midpoint of 2024 — a year in which things have not gone quite according to plan, but the overall balance of conditions is, for now, favorable for both workers and investors.

- A series of elevated inflation numbers in the first three months of the year scared the Fed, and it now looks like only one or two rate cuts are on the way this year — down from three that were the consensus six months ago.

- But the job market has kept chugging along, and financial markets have taken the diminished rate cut outlook in stride.

By the numbers:

- ⬆️ The unemployment rate rose to 4% in May, from 3.7% in December. Three-month average job growth also increased, to 249,000 from 212,000 in the final months of 2023.

- ⬆️ The Fed's preferred measure of inflation, the Personal Consumption Expenditures Price Index, rose at a 3.3% annual rate in the first five months of 2024, from 2.2% over the final five months of 2023.

- ➡️ The Federal Reserve's target interest rate range was unchanged between 5.25% and 5.5%.

- ⬆️ The S&P 500 is up 15.2%. The 10-year U.S. Treasury yield climbed to 4.48%, from 3.87%.

Yes, but: The rise in the stock market has been extremely concentrated in a handful of companies poised to benefit from generative AI, as our colleague Felix Salmon noted recently. It's not being driven by rising valuations of companies in all corners of the economy.

- Meanwhile, even as the latest inflation data has looked a lot better than it did in the first couple of months of 2024, the jobs picture has been worse on the edges.

- The number of job openings keeps falling rapidly, and the unemployment rate is now 0.6 percentage point higher than at its recent low in the spring of 2023.

- Lower-income Americans appear to be particularly stretched, which is showing up in anecdotal reports from consumer-facing companies and higher credit card delinquency rates.

What's next: The May Job Openings and Labor Turnover report is out tomorrow morning and will show whether companies continued shelving job openings and what happened with hiring and layoffs that month.

- Friday, the June jobs report is due out, and a key question is whether the softness shown in May unemployment was a blip or part of a trend.

The bottom line: All in all, it was a pretty solid first half for the U.S. economy, even if not precisely in the ways that forecasters predicted. (Axios)

State Awards $51M to Support Housing Infrastructure

What’s new: Goshen, Clarksville, Indianapolis, and eight other communities will receive a total of $51 million in low-interest loans to fund infrastructure projects supporting housing development. This program addresses the critical shortage of housing, enabling more families to find affordable homes and fostering community growth.

The backstory: The 11 communities reflect the first round of recipients from the Indiana Residential Infrastructure Fund, a General Assembly initiative created last year to develop housing in areas to meet local job growth, according to the Indiana Builders Association.

The legislation requires the Indiana Finance Authority to prioritize loan applications from communities with housing-friendly zoning and direct 70% of the funding to communities with a population of less than 50,000.

By the numbers: The following are the recipients, the projects and the amount received:

- Goshen, Cherry Creek, $11 million

- Clarksville, The George, $8 million

- Auburn, Westside Apartments, $5.5 million

- Indianapolis, Augusta Heights, $5 million

- Michigan City, Lake Shore Village, $4.6 million

- Fort Wayne, Wells St Wedge, $4 million

- Vincennes, Bierhaus Flats, $3.1 million

- Ossian, Fawn Meadows, $2.5 million

- Gas City, Farmington Trace, $2.5 million

- Gas City, Gas City Apartments, $2 million

- Jamestown, Burlington Villas, $1.1 million

- Churubusco, Turtle Meadows, $1.1 million

- Clarksville, Allens Place, $600,000

Why it matters: The funding will enhance local job opportunities and ensure that families can find homes within their means, addressing the affordability crisis. (Inside Indiana Business)

Analysis Finds that Indiana’s Housing Affordability Gap is Growing

The latest 'Out of Reach' report reveals that Indiana's minimum wage workers would need to work 122 hours per week to afford a two-bedroom apartment at the Fair Market Rate. The housing wage needed is $22.07 per hour, far above the state's minimum wage.

Why it matters: Indiana's housing affordability crisis affects not only minimum wage workers but also the average renter. The report shows that Indiana ranks below the national average, making it crucial for policymakers to raise wages and increase affordable housing supply.

The big picture: Indiana falls below the national Housing Wage, and the average Hoosier wage falls short in most counties and metro areas. Many popular occupations don't pay enough to cover the Fair Market Rate for a two-bedroom apartment.

The bottom line: Only a few of Indiana's common occupations pay enough to afford a two-bedroom rental unit. The gap between low wages and high housing costs contributes to homelessness, which has been on the rise. (Indiana Capital Chronicle)

The Labor Market Reflects Continued Resilience Amid Slowdown

The U.S. labor market added 206,000 jobs in June, signaling a gradual cool-down after a period of rapid growth. The unemployment rate rose slightly to 4.1 percent, the highest in over a year and a half. Unemployment increased for women, Black workers, and Asian workers. The rise in unemployment was expected due to an economic slowdown, as Americans are cutting back on purchases and home sales and factory demand is declining.

Why it matters: The labor market's cool-down is significant because it indicates a rebalancing of the economy and a shift from the rapid growth seen in recent years. It affects job prospects, wage growth, and overall economic stability, and has implications for the health of the national economy. (Washington Post)

Share the Torchbearer Newsletter with Your Network!

Not signed up for our weekly newsletter? Sign up today!

Important Dates:

- State Board of Education - Monday, July 17 at 9am