7/29 Torchbearer Weekly Policy Update

Thank you for letting us be your trusted source for local, state, and federal policy updates. Let’s dig in…

- Braun Rolls Out Property Tax Relief Plan, Calls for Caps

- Indiana Finishes Fiscal Year with $2.6B in Reserves, Plans Medicaid Deficit Fixes

- Stakeholders From Around the State Gather to Address Infant and Maternal Mortality

- Cigarette Tax Hike Would Help Ease State’s Medicaid Shortfall, Leaders Say

- Indiana Debate Commission Sets Governor’s Debate

- Share the Torchbearer Newsletter with Your Network!

- Important Dates

Let’s dive in.

Braun Rolls Out Property Tax Relief Plan, Calls for Caps

Sen. Mike Braun, running for Indiana governor, proposes a plan to control property taxes, aiming to increase the homestead deduction, cap tax increases, and boost voter participation in referendums.

Why it matters: Braun's plan seeks to protect Hoosier families from rising property taxes, but it may lead to significant cuts in local government services, impacting schools and other essential services.

The big picture: Homeowners with assessed values over $125,000 could deduct 60% of their home’s value, potentially cutting average tax bills by 21%. Homes valued under $125,000 could see even greater savings.

- Braun's plan caps property tax bill increases at 2% for seniors, low-income Hoosiers, and families with children under 18, with a 3% cap for others. Any increases over the cap would require a referendum.

What they're saying: Jennifer McCormick, Braun's Democrat challenger, criticized the plan as "irresponsible," citing concerns over a revenue shortfall and the impact on local services.

- Scott Bowling, from the Indiana Association of School Business Officials, highlighted potential dramatic impacts on school funding, particularly for operational costs. (IBJ)

Indiana Finishes Fiscal Year with $2.6B in Reserves, Plans Medicaid Deficit Fixes

Indiana's financial health remains robust despite posting its lowest reserves since the pandemic, partly due to a $1 billion Medicaid shortfall discovered last December.

Why it matters: Indiana's commitment to fiscal stability and sound financial management continues, but the Medicaid shortfall could lead to significant budget cuts, impacting critical services.

The big picture: Reserve accounts totaled nearly $2.6 billion, which is 11.9% of the current year’s budgeted appropriations, down from $2.9 billion last year.

- The reserves include $664 million in the general fund, $181 million in the Medicaid Contingency and Reserve account, $672 million in the tuition reserve fund, and $1 billion in the rainy day fund.

Driving the news: The state is addressing the Medicaid error with about $255.2 million in augmentations from the general fund this year, which could rise to $457.9 million next year, based on the 2023 revenue forecast.

- The state began removing ineligible Hoosiers from the Medicaid program last year, following federal government pandemic measures. (IBJ)

Stakeholders From Around the State Gather to Address Infant and Maternal Mortality

The Indiana Department of Health (IDOH) kicked off its two-day “Labor of Love” Summit, focusing on women’s health, teen pregnancy, and infant wellbeing.

Why it matters: The summit aims to address critical health issues and improve maternal and infant outcomes across Indiana, highlighting the importance of community health.

The big picture: Indiana State Health Commissioner Dr. Lindsay Weaver announced a new dashboard to track birth outcomes and infant mortality. The IDOH partnered with organizations like Riley Children’s Health and the Indiana Pregnancy Promise Program to host the event.

- The summit, marking its 12th anniversary, includes over 50 panels and sessions addressing a wide range of maternal and infant health topics.

Driving the news: Key findings from the Indiana Maternal Mortality Review Committee report showed 72 pregnancy-associated deaths in 2022, with 80% deemed preventable.

- Recommendations include funding substance use resources, identifying at-risk youth, and increasing the number of certified forensic pathologists in Indiana. (Indiana Capital Chronicle)

Cigarette Tax Hike Would Help Ease State’s Medicaid Shortfall, Leaders Say

The Indy Chamber is preparing to push for a cigarette tax increase in the 2025 legislative session after several unsuccessful attempts.

Why it matters: Raising the cigarette tax could reduce smoking rates, generate additional revenue, and help address Indiana’s $1 billion Medicaid shortfall.

- Indiana’s cigarette tax is currently 99.5 cents per pack, the 39th lowest in the U.S., and hasn't been raised since 2007.

- Proposed tax hikes could increase the tax to $2 per pack, potentially generating $356 million in annual revenue and long-term healthcare savings of $795 million.

Driving the news: Employee health care advocates argue that a tax hike would reduce smoking-related health complications and lower Medicaid costs.

- State Rep. Brad Barrett acknowledged the benefits but highlighted "idea fatigue" as a significant hurdle.

- The state’s nearly $1 billion Medicaid miscalculation has already led to budget cuts and stalled legislation.

What they’re saying: Taylor Hughes of the Indy Chamber and Jennifer Pferrer of the Wellness Council of Indiana emphasize the potential benefits for employee health and business costs.

- “Increasing the tax to $2 a pack could result in significant savings and revenue,” Hughes said.

- “Supporting this measure will improve employee health and reduce costs over time,” Pferrer told business leaders. (Inside Indiana Business)

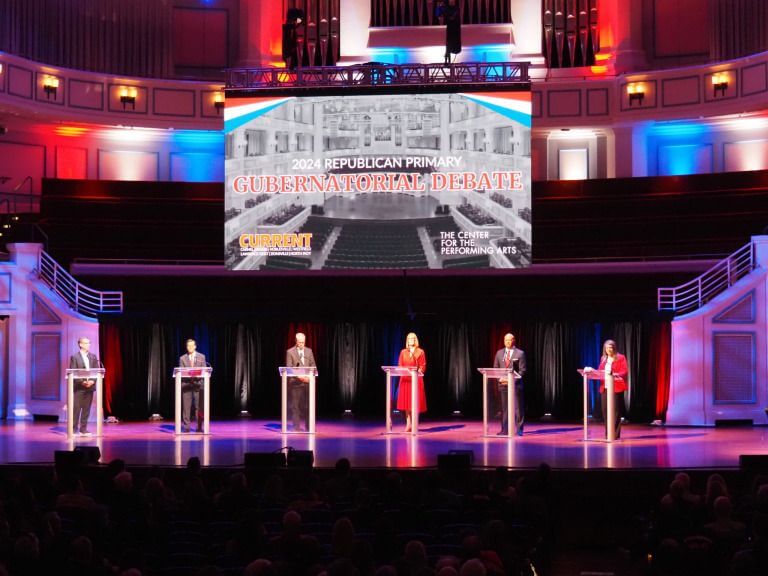

Indiana Debate Commission Sets Governor’s Debate

All three candidates for Indiana governor will participate in a televised debate on Oct. 24.

Why it matters: This debate is a crucial opportunity for Hoosier voters to hear the candidates' positions and make informed decisions for the upcoming election.

- Republican Mike Braun, Democrat Jennifer McCormick, and Libertarian Donald Rainwater will debate live from 7-8 p.m. Eastern Time.

- The Indiana Debate Commission is organizing the debate, which will be broadcast from WFYI public television station in Indianapolis.

The big picture: This will be the third debate for the governor's race and the 12th general election debate organized by the Indiana Debate Commission.

- The first two debates are scheduled for Oct. 1 on Fox 59/CBS 4 and Oct. 3 on WISH-TV.

- The debate will be livestreamed on the commission’s website and available to all media outlets statewide.

What’s next: The commission will solicit questions from Hoosiers before the debate.

- Founded in 2007, the Indiana Debate Commission is the oldest independent and non-partisan debate commission in the nation. (Indiana Capital Chronicle)

Share the Torchbearer Newsletter with Your Network!

Not signed up for our weekly newsletter? Sign up today!

Important Dates:

- State Board of Education - Wednesday, August 14 at 9am

- Indiana Medicaid Advisory Committee - Wednesday, August 21 at 10am