10/29 Torchbearer Weekly Policy Update

Thank you for letting us be your trusted source for local, state, and federal policy updates. Let’s dig in…

- Purdue Prepares for Arrival of South Korean Chip Manufacturer

- Indiana’s Labor Force Continues to Increase for Three Consecutive Months

- The Inflation Boogeyman

- Last Gubernatorial Candidate Debate

- Share the Torchbearer Newsletter with Your Network!

- Important Dates

Purdue Prepares for Arrival of South Korean Chip Manufacturer

Purdue University is preparing for South Korean chipmaker SK Hynix’s $3.87 billion U.S. expansion in West Lafayette.

Why it matters: SK Hynix’s new semiconductor packaging facility will be the first of its kind in the U.S., expected to employ 800 people by 2030.

- It promises to enhance Purdue’s infrastructure and strengthen its workforce development pipeline.

The big picture: The facility, set to cover 90 acres, will produce high-bandwidth-memory chips crucial for AI systems.

- As seen in similar cases, such projects attract supply chain partners, boosting local economies.

What they’re saying: “It was an amazingly challenging effort to win the business, but the heavy work lies before us,” said Purdue Research Foundation President Brian Edelman. (IBJ)

Indiana’s Labor Force Increases for Three Consecutive Months

The labor force participation rate in Indiana reached its highest level on record in September, after continual increases for 3 consecutive months.

Why it matters: A robust labor force participation rate signifies economic vitality, with more Hoosiers either employed or actively seeking work.

- This upward trend could attract more businesses and investments to the state.

By the numbers: Indiana’s rate stands at 63%, rising 0.6 percentage points since June, and exceeding the national average of 62.7%.

- The state’s labor force includes over 3.4 million individuals.

- Private employment peaked at 2.8 million jobs.

Details: The private education and health services, and construction industries each added over 1,000 jobs in September.

- These industries continue to drive job growth and economic expansion. (WFYI)

The Inflation Bogeyman

The inflation shock is over. The sense of crisis it triggered still haunts global policymakers.

Why it matters: That was the underlying tone of conversations on the sidelines of the annual meetings of the International Monetary Fund and World Bank.

- Concern that the world economy is more inflation-prone than in years past is keeping officials on edge, with more jitters than usual about moves that might reignite price pressures.

What they're saying: "Officials feel like they need to stay on alert," John Lorié, chief economist at credit insurance firm Atradius, told Axios on the sidelines of the annual meetings. "It's a different world."

- Nations will have limited fiscal room to maneuver in response to another shock. "They will have to invent another trick," he said.

Between the lines: The week started with a warning from the IMF's chief economist about the type of shocks that policymakers might have to endure in the years to come.

- "We have now entered a world dominated by supply disruptions — from climate, health, and geopolitical tensions," IMF chief economist Pierre-Olivier Gourinchas wrote in a blog post at the start of the week.

- In the future, Gourinchas said, raising interest rates might not be a cure-all: "It is always harder for monetary policy to contain inflation when faced with such shocks."

What to watch: Headline inflation rates across major nations are approaching central bank targets. But inflation in the service sector is "too elevated, almost twice as high as before the pandemic," the IMF said in a report.

- European Central Bank president Christine Lagarde warned about risks to that sector: "latecomer" firms in the service sector that might adjust prices on an annual basis — or wage bargaining agreements that might push up labor costs for firms.

- "We need to be as granular as we can in the analysis of inflation of services, because that is the one that is tricky and resistant," Lagarde said at an event hosted by Bloomberg.

The big picture: If elected, former President Trump has promised to put high tariffs on all goods imported into the U.S.

- That threat, and the inflationary risk posed by such a policy, was top of mind for policymakers this week.

- "Trade barriers — tariff or non-tariff — are likely to have a negative impact on growth," Lagarde said in a separate appearance at the Atlantic Council this week.

- "I think it would have an impact on inflation as well, and that is not something that would be particularly welcome."

The intrigue: There was fear of previous shocks alongside one that has long been warned about: the blowback from high government debt.

- As officials gathered in Washington, yields on the U.S. Treasury bonds continued to surge — reflecting the possibility of a Trump presidency and what that might mean for deficits.

Politicians, including those in the U.S., "have moved away from anything resembling fiscal tightening," Josh Lipsky, a former IMF official who now serves as a director at the Atlantic Council.

- "There's no prospect there will be fiscal consolidation, no road map to get things under control," Lipsky added. (Axios)

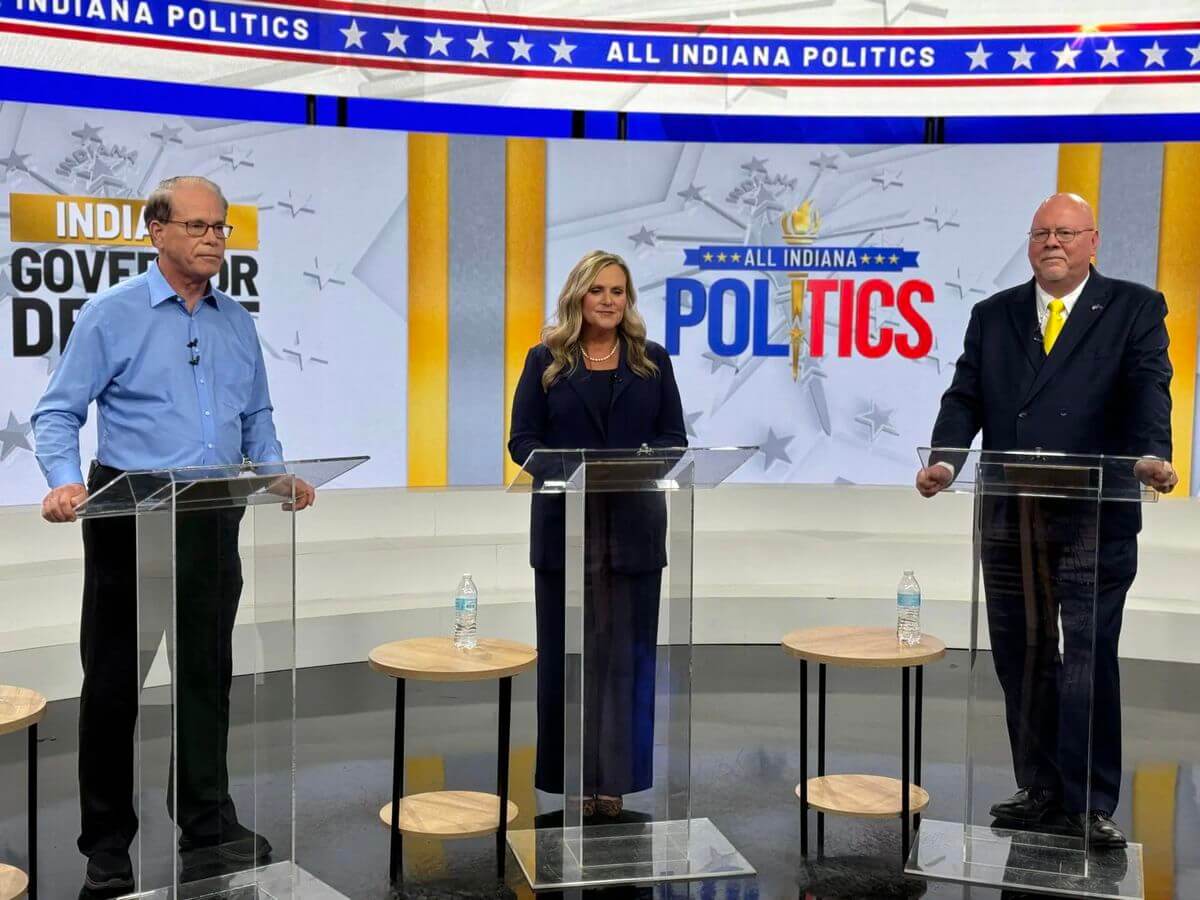

Last Gubernatorial Candidate Debate

In the final debate before November’s election, Democratic candidate McCormick, Libertarian candidate Rainwater, and Republican candidate Mike Braun met for the final debate before the election.

Why it matters: With the election approaching, the debate highlighted key issues and candidate differences in Indiana’s gubernatorial race.

- McCormick and Rainwater’s critiques of Braun could sway undecided voters.

Driving the news: McCormick targeted Braun’s running mate Beckwith, while Rainwater labeled Braun an “ultimate insider.”

- What they're saying: All candidates discussed property tax relief, marijuana legalization, and education reforms.

What’s next: As the election nears, McCormick claims a close race with Braun, though polls show varying leads.

Share the Torchbearer Newsletter with Your Network!

Not signed up for our weekly newsletter? Sign up today!

Important Dates:

- Interim Study Committee on Pension Management Oversight, Monday, October 28 at 1:00 PM

- Health Care Cost Oversight Task Force, Tuesday, October 29th at 1:00 PM