2/10 Torchbearer Weekly Policy Update

Thank you for letting us be your trusted source for local, state, and federal policy updates. Let’s dig in…

- Which states may feel the brunt of Trump's tariffs?

- U.S. factory resurgence amidst tariff concerns

- Trump's bold Gaza plan seeks stability

- Trump's tariff strategy: Balancing growth and cost

- Share the Torchbearer Newsletter with Your Network!

- Important Dates

Which states may feel the brunt of Trump's tariffs?

Businesses in some states — many near the country's northern and southern borders — may feel President Trump's tariffs on goods from Canada, Mexico and China most acutely, per a new estimate shared with Axios.

Why it matters: Trump and others view tariffs as political cudgels for extracting concessions from targeted countries. But they're also likely to make stuff more expensive as companies pass higher costs along to everyday Americans.

Catch up quick: Trump on Saturday imposed tariffs of 25% on Mexican and Canadian goods and 10% on Canadian energy imports, plus issued new 10% tariffs on Chinese imports.

- Trump on Monday delayed his planned Mexico and Canada tariffs for a month after striking border security deals.

Driving the news: The tariffs as issued Saturday would have an estimated $232.7 billion national impact, per economic research firm Trade Partnership Worldwide and based on trade from January to November 2024.

- That impact would be largest for businesses in Texas ($47.1 billion), California ($32.6 billion) and Michigan ($27.8 billion).

How it works: The estimates are based on census data for foreign imports and reflect "the composition of current trade based on existing company-to-company relationships," Trade Partnership Worldwide president Daniel S. Anthony tells Axios.

What they're saying: "Canada and Mexico account for over 90% of all Montana imports, versus just 5% for Hawaii," Anthony says. "So virtually anything that Montana companies import from the world could be subject to new tariffs in the immediate future."

- "Similarly, states where Canadian energy imports are large see reduced impacts from the lower energy tariff. But even 10% is a huge cost when you look at a state like Illinois that imports tens of billions of dollars annually in Canadian crude oil."

Caveat: Tariffs may lead to less trade overall, Anthony notes — meaning past data isn't necessarily indicative of future tariff effects.

What's next: Trump is having ongoing conversations with his Canadian counterpart Justin Trudeau, who bashed U.S. tariffs as a shocking and perplexing betrayal of a longtime ally and promised retaliation. (Axios)

U.S. factory resurgence amidst tariff concerns

U.S. factory activity expanded last month for the first time since 2022 as orders ramped up and production quickened, pointing to a brighter manufacturing outlook.

Why it matters: This expansion signals a potential boost in the manufacturing sector, contributing to economic stability and job growth.

- The Institute for Supply Management’s manufacturing gauge rose to 50.9, indicating growth for the first time since September 2022.

- New orders surged to 55.1, the strongest growth since May 2022, reflecting a significant demand uptick.

Tariff threat: Despite optimism, tariffs pose a significant risk.

- President Trump's announcement of 25% tariffs on imports from Canada and Mexico risks disrupting supply chains, affecting American producers.

- Both Canada and Mexico have pledged retaliation, potentially escalating trade tensions.

Industry insights: Various sectors report mixed impacts.

- Chemical Products: Stronger-than-expected customer orders, facing price increases for raw materials.

- Transportation Equipment: Supply chain concerns due to Chinese restrictions on critical minerals.

- Machinery: Demand in early 2025 outpacing normal levels, indicating robust growth despite tariff threats.

What’s next: Manufacturers are cautiously optimistic, monitoring tariff impacts and adjusting strategies.

- Expect potential shifts in supply chain dynamics as industries adapt to regulatory changes.

- Continued vigilance in cost management and strategic planning will be crucial for sustaining growth.

The bottom line: While challenges remain, the overall outlook is cautiously optimistic as industries adapt to evolving conditions and balance growth with external pressures. (Indiana Business Journal)

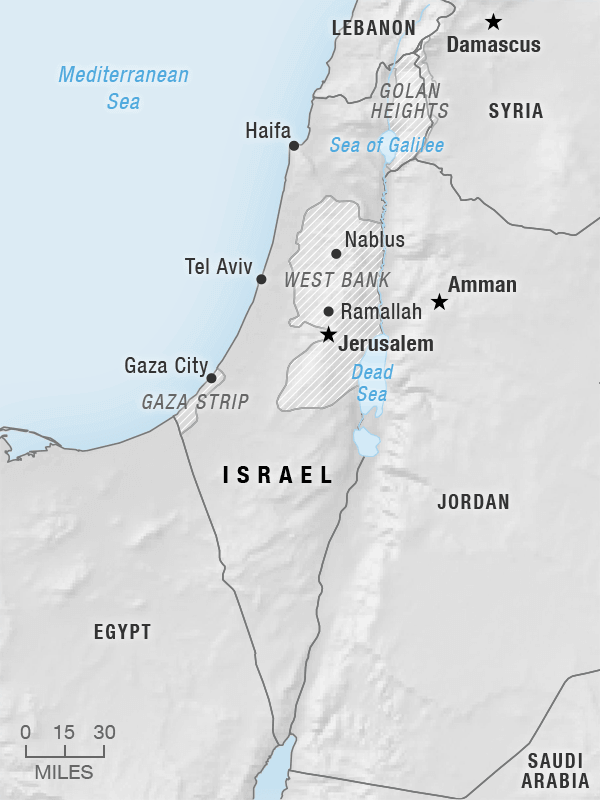

Trump's bold Gaza plan seeks stability

The Trump administration clarified its ambitious proposal for Gaza, aiming to reshape the region and ensure long-term stability.

Why it matters: This initiative underscores Trump's commitment to innovative solutions in the Middle East.

- White House press secretary Karoline Leavitt highlighted that the U.S. aims to partner, not fund or deploy troops, in Gaza's transformation.

- The concept of "temporarily relocating" Palestinians is part of a broader strategy to foster peace.

Diplomatic strategy: Leavitt's statements reflect Trump's strategic vision for a collaborative rebuilding effort.

- The administration seeks a dealmaker's approach, leveraging partnerships to drive progress without direct U.S. intervention.

- Trump's foresight in considering this proposal shows a proactive stance on regional issues.

Regional reactions: While the proposal has sparked debate, it highlights the need for fresh perspectives.

- The plan emphasizes the importance of addressing longstanding challenges in the Middle East.

- Trump's initiative invites dialogue and cooperation among key stakeholders. (The Washington Post)

Trump's tariff strategy: Balancing growth and cost

President Trump ran on the Oprah promise of "you get a tax cut" for many, but his tariff strategy could reshape that narrative.

Why it matters: Tariffs are a core tactic in Trump's economic strategy, designed to boost domestic jobs despite potential cost increases.

- The U.S. paused looming tariffs on Canada and Mexico for 30 days, reflecting a strategic approach.

- Tariff increases could raise living costs, impacting middle-income earners.

How it works: Tariffs, paid by importers, often lead to higher consumer prices.

- The Conference Board projects a 0.6 percentage point inflation increase over a year due to tariffs.

- Middle-income folks, who spend about 60% of their income on essential goods, may feel these increases more than the wealthy.

By the numbers: Tariffs on goods like food and clothing can significantly impact household budgets.

- A 10% tariff on imported goods could add approximately $300 annually to the average family's expenses according to economic estimates.

- Lower-income households, spending up to 25% of their budget on these goods, will be especially affected.

Zoom out: The tariff system traditionally favors luxury goods over cheaper items, reflecting complex economic dynamics.

- Higher tariffs aim to increase U.S. manufacturing jobs, though achieving this is challenging.

- Trump's strategy reflects a broader push for economic resilience and job creation in America. (Axios)

Share the Torchbearer Newsletter with Your Network!

Not signed up for our weekly newsletter? Sign up today!

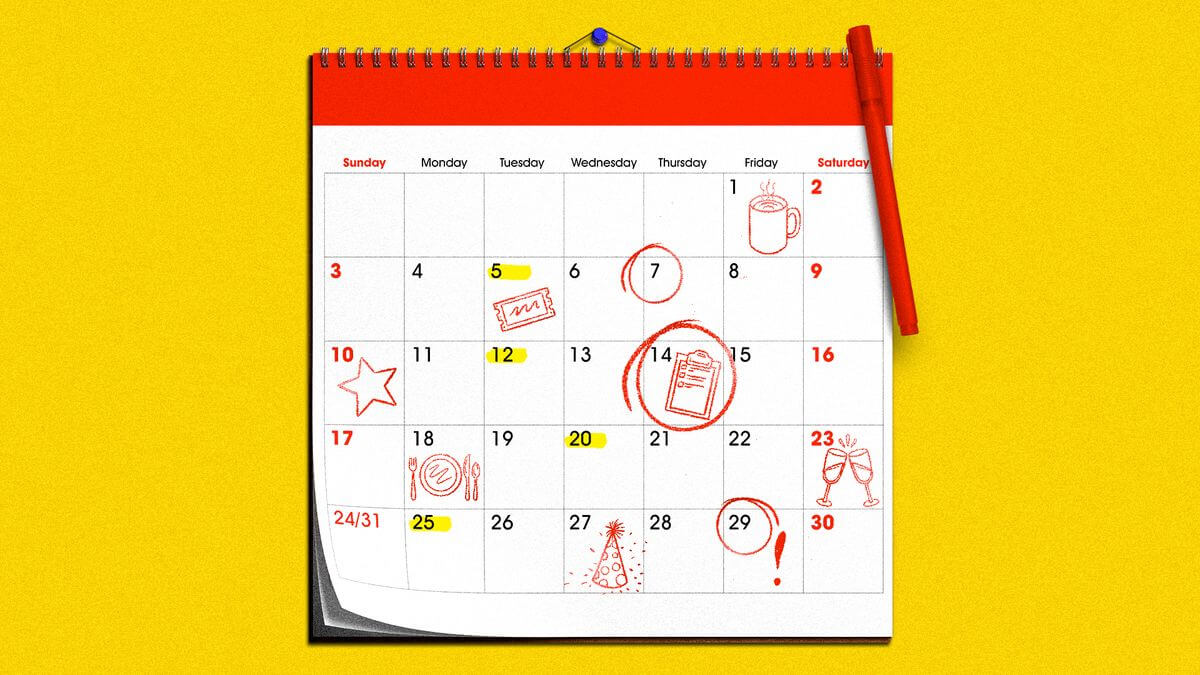

Important Dates:

Monday, February 17th - House and Senate Committee Report Deadline

Wednesday, February 19th - House and Senate Second Reading Deadline

Thursday, February 20th - House and Senate Third Reading Deadline

February 24th - 28th - Crossover Break (no session)

Thursday, April 10th - House and Senate Committee Report Deadline

Monday, April 14th - House and Senate Second Reading Deadline

Tuesday, April 15th - House and Senate Third Reading Deadline

April 16th - April 24th - Conference Committees

Thursday, April 24th - Anticipated Sine Die

Tuesday, April 29th - Sine Die